Q2 FY12/25 Financial Results Briefing

Shinichiro Fujisaki (“Fujisaki”): Good afternoon, everyone. I am Shinichiro Fujisaki, President & CEO of AUCNET INC. Thank you very much for taking the time out of your busy schedules to join our financial results briefing today.

This year, AUCNET proudly celebrated its 40th anniversary. On June 27, we held a commemorative event attended by representatives from over 500 companies. It was a highly meaningful occasion to share our history and business, and to reaffirm the strong expectations placed on us.

As our fiscal year ends in December, we announced yesterday, following a resolution of the Board of Directors, the financial results for the first half. Many of you may have reviewed the summary, but I am pleased to report that we have raised our full-year earnings forecast.

While this is certainly encouraging from a business standpoint, we must also reflect from a management perspective, as revisions were made not only in the first quarter but again in the second quarter. Going forward, we will work to deliver more accurate forecasts and clearer explanations. We sincerely appreciate your continued support.

Table of Contents

I will now present the H1 financial results in line with today’s agenda, covering five items.

First, a summary of the second quarter cumulative, or first-half, results. Second, a summary of results by segment. Third, a more detailed breakdown of results by segment. Fourth, key topics. And fifth, an overview of material issues formulated in relation to sustainability.

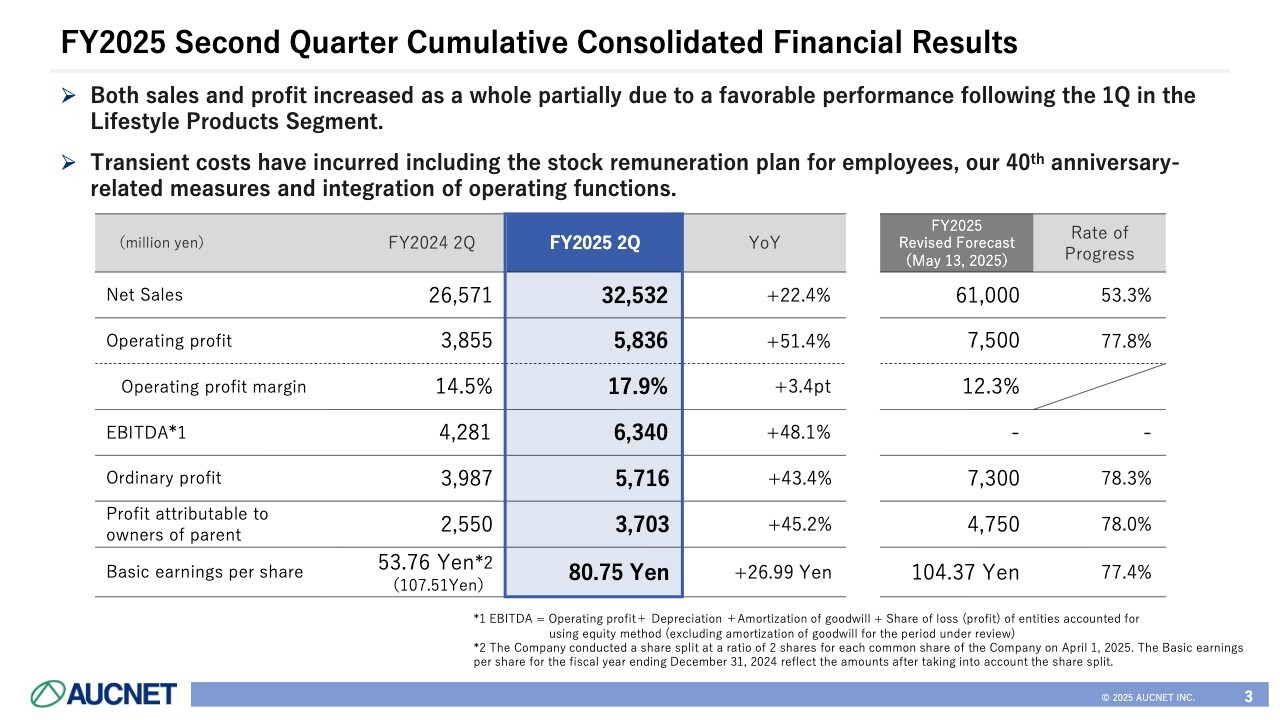

FY2025 Second Quarter Cumulative Consolidated Financial Results

Here is a summary of the consolidated financial results. Following a favorable performance in the first quarter, Lifestyle Products continued to deliver robust growth, resulting in higher sales and profit overall.

During the first half, we recorded one-time costs related to the introduction of a stock remuneration plan for employees, our 40th anniversary-related events and initiatives, and the integration of operating functions. Among others, the operational enhancements, particularly in the Fashion Resale Business and also in other businesses, were key areas of focus.

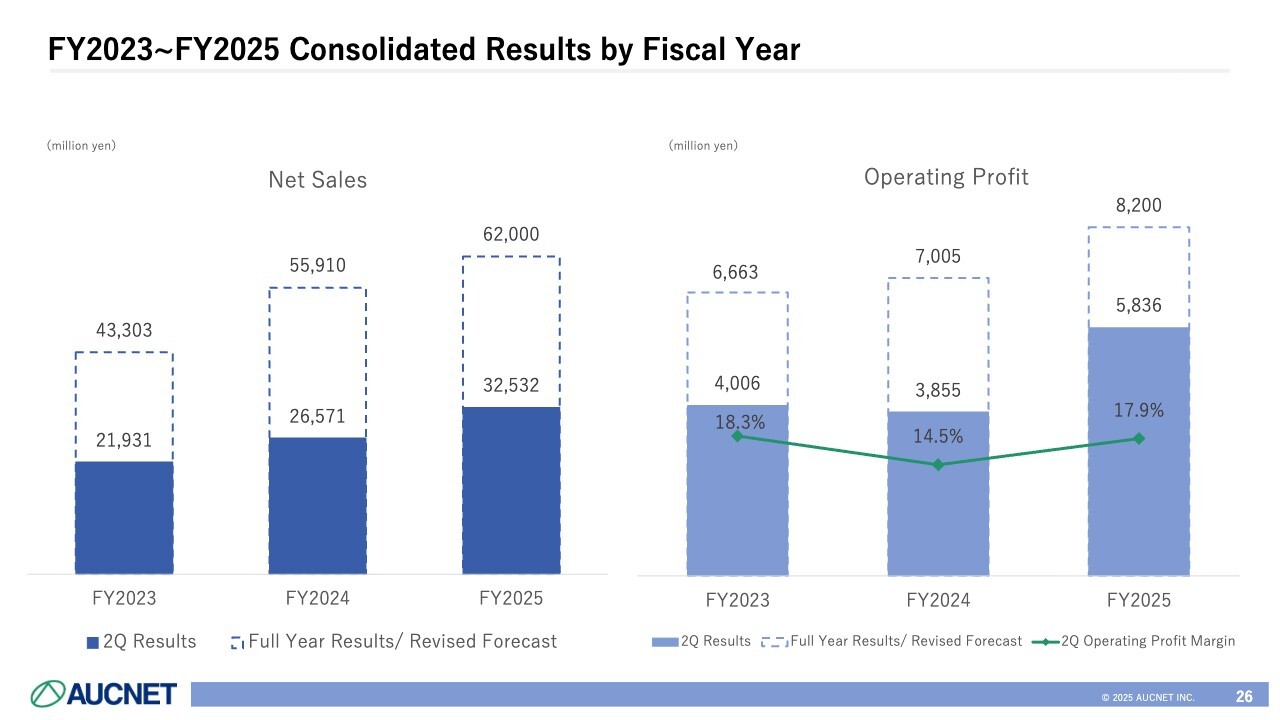

Net sales totaled 32,532 million yen, up 22.4% year on year, representing 53.3% progress toward the revised forecast announced in May.

Operating profit was 5,836 million yen, up 51.4% year on year, with progress reaching 77.8% and steadily accumulating. The operating profit margin improved by 3.4 points year on year to 17.9%.

EBITDA was 6,340 million yen, up 48.1% year on year. Ordinary profit was 5,716 million yen, up 43.4% year on year.

Profit attributable to owners of parent was 3,703 million yen, up 45.2% year on year, achieving 78.0% of the full-year forecast. Basic earnings per share rose by JPY26.99 to JPY80.75.

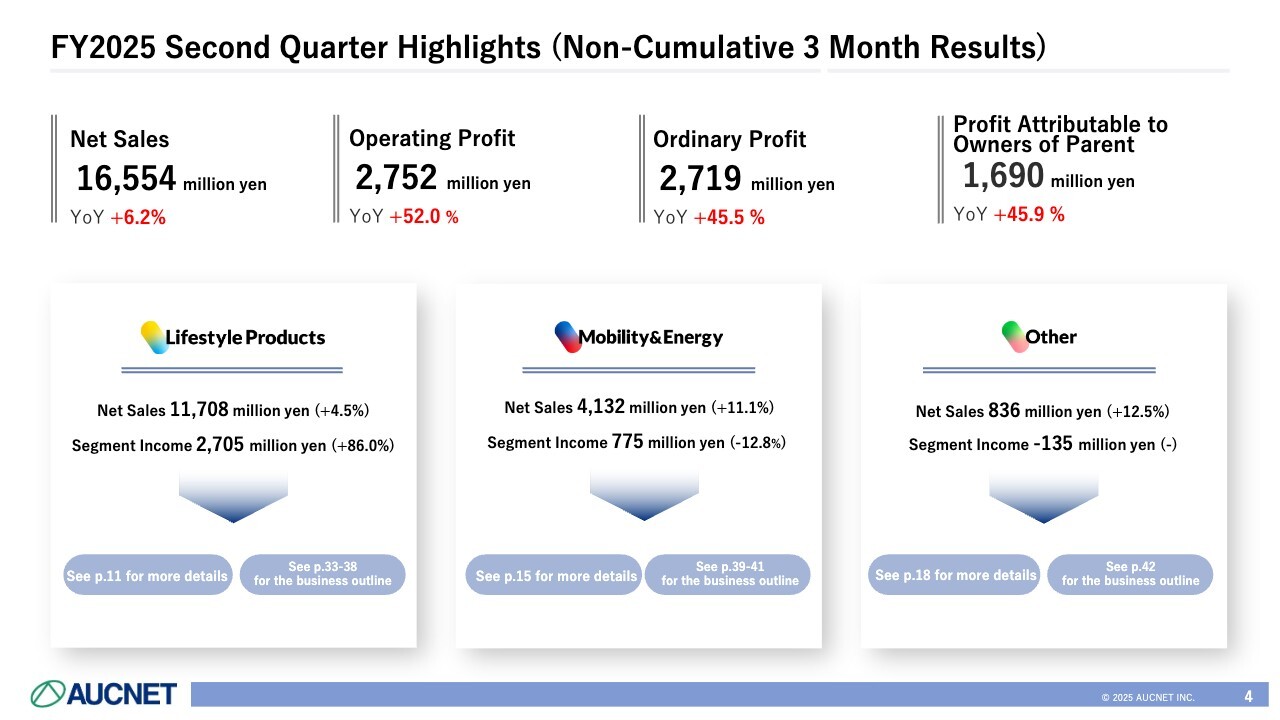

FY2025 Second Quarter Highlights (Non-Cumulative 3 Months Results)

Here are the highlights for the second quarter alone. Overall, we delivered very strong results, with net sales of 16,554 million yen, up 6.2% year on year; operating profit of 2,752 million yen, up 52.0% year on year; ordinary profit of 2,719 million yen, up 45.5% year on year; and profit attributable to owners of parent of 1,690 million yen, up 45.9% year on year.

The figures by segment are shown at the bottom of the slide. Focusing on profit, Lifestyle Products performed strongly, posting segment income of 2,705 million yen, up 86.0% year on year. In contrast, Mobility & Energy recorded segment income of 775 million yen, down 12.8% year on year.

To add some context, Mobility & Energy, which includes the Automobile Business, has many employees. As a result, a large part of the costs for the stock remuneration plan I mentioned earlier was recorded in the second quarter. Without this cost, the segment would have shown a slight profit increase.

Other posted a segment loss of 135 million yen.

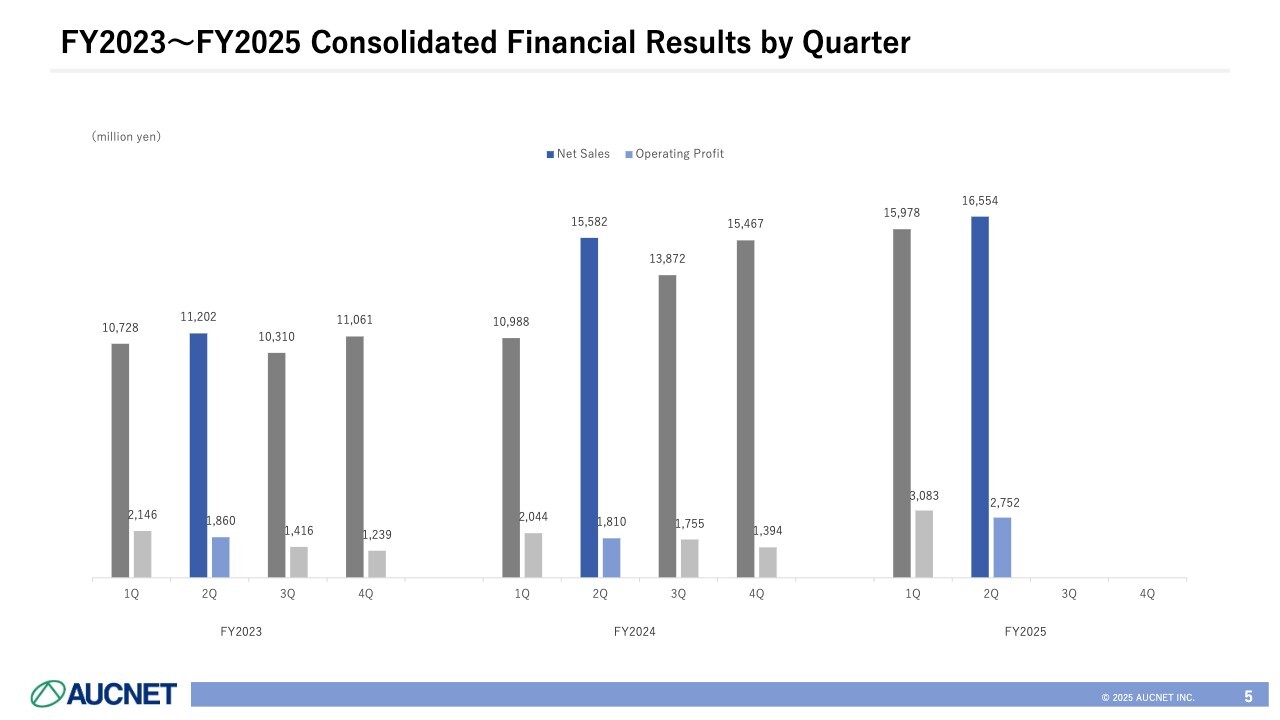

FY2023–FY2025 Consolidated Financial Results by Quarter

This graph shows quarterly changes in consolidated financial results. As indicated, net sales began to increase significantly in the second quarter of FY2024. This is because Defactostandard, Ltd. and JOYLAB, inc., which we acquired last year, were consolidated in the second quarter of that year.

So, when looking only at the first half, please note that the increase in the first quarter of FY2025 had a large impact.

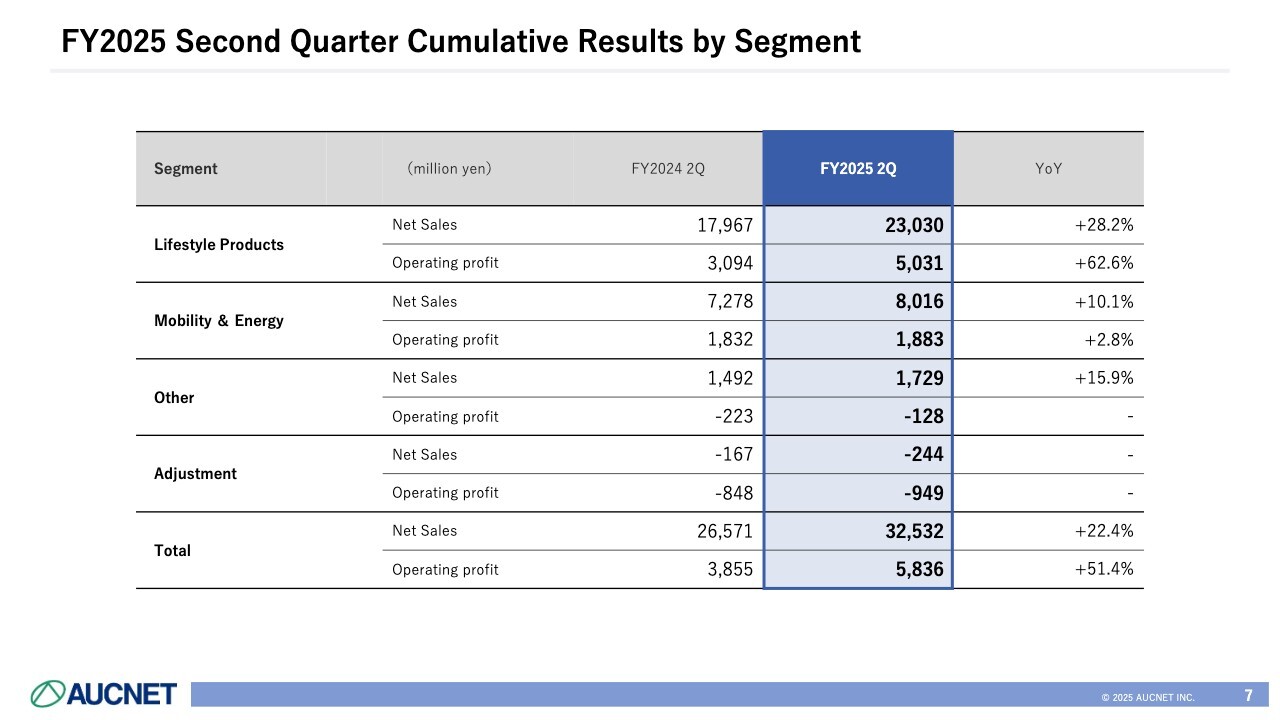

FY2025 Second Quarter Cumulative Results by Segment

This is a summary of results by segment. Operating profit for Lifestyle Products increased 62.6% year on year to 5,031 million yen, making a significant contribution to overall performance.

Mobility & Energy, which always has a stable operating profit, posted a 2.8% year-on-year profit increase to 1,883 million yen.

Other posted an operating loss of 128 million yen. However, compared with last year, the loss was reduced by approximately 100 million yen on an operating profit basis.

There was an adjustment of about 950 million yen reflecting overall costs and other factors, bringing total operating profit to 5,836 million yen.

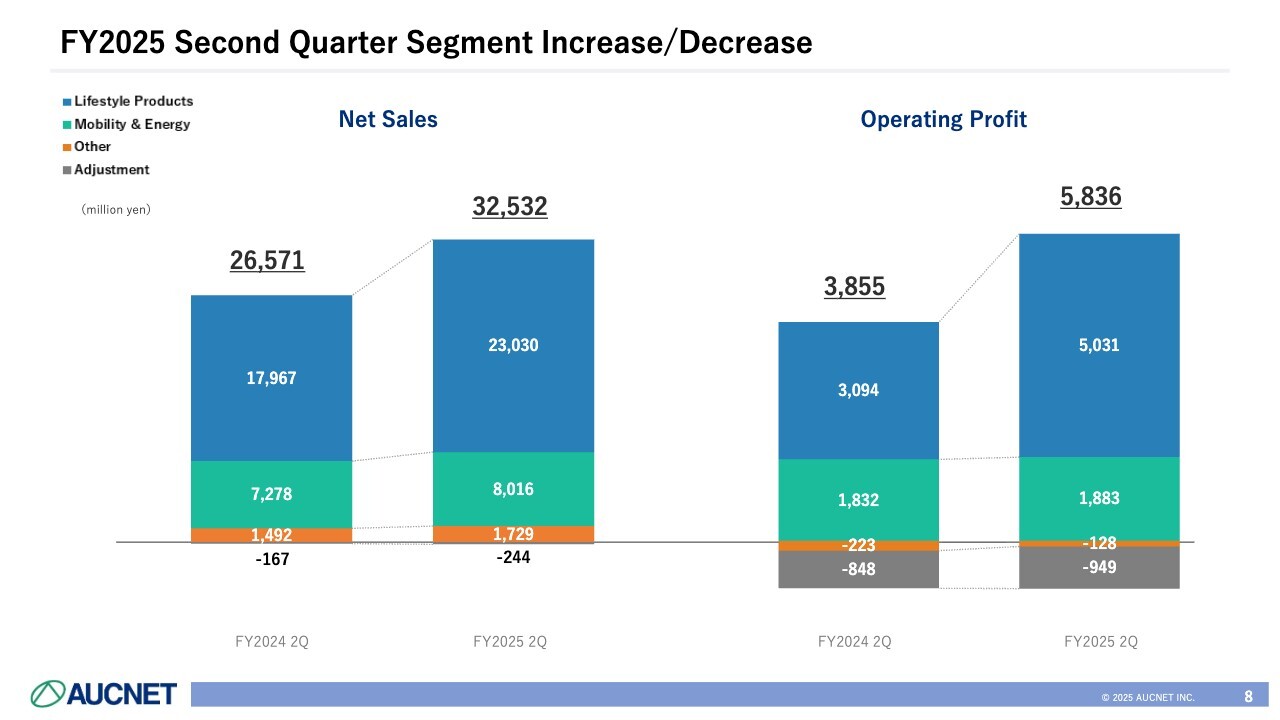

FY2025 Second Quarter Segment Increase/Decrease

This is an analysis of increase/decrease by segment, with bar charts for net sales and operating profit. Lifestyle Products, at the top in blue, performed exceptionally well and drove overall results.

FY2025 Second Quarter Cumulative Transaction Amount by Segment

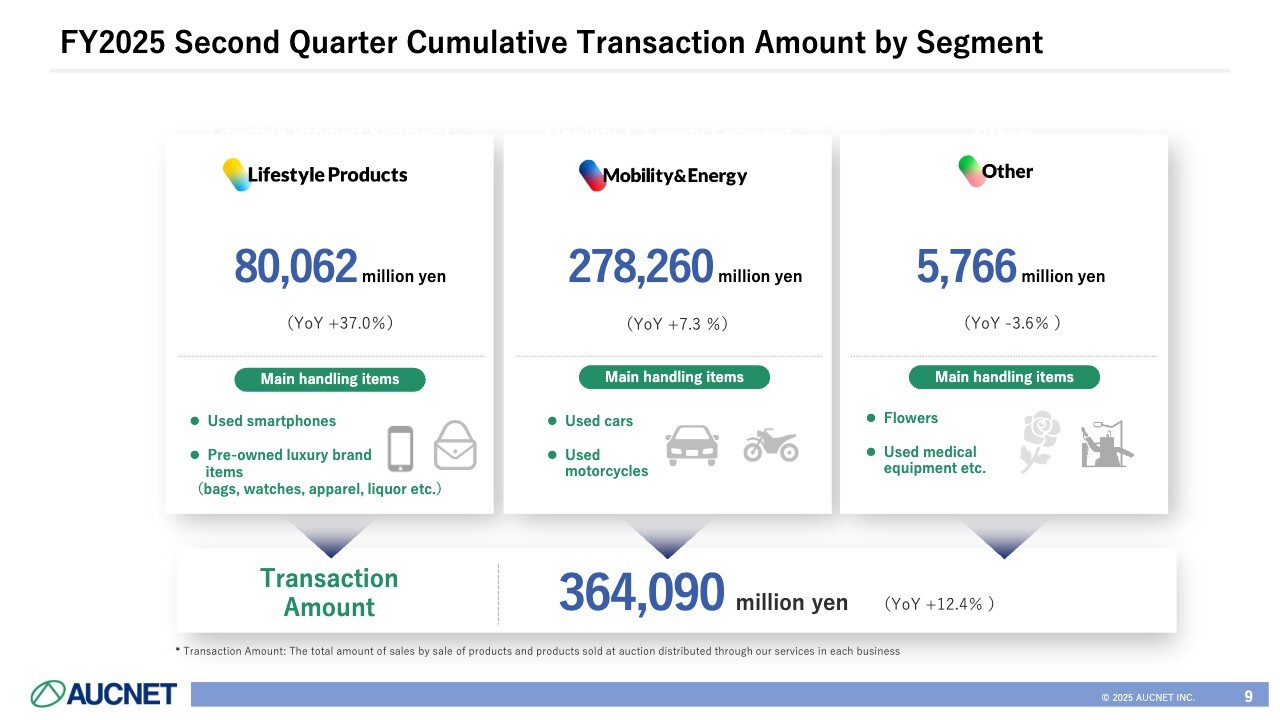

This slide shows the transaction amount by segment. For the first half of this fiscal year, the total transaction amount reached 364.0 billion yen, up 12.4% year on year.

The transaction amount for Lifestyle Products reached approximately 80.0 billion yen, up 37.0% year on year, indicating strong performance.

Mobility & Energy, which includes automobiles, handles higher-priced products. As a result, transaction volume rose 7.3% year on year to 278.2 billion yen. This increase was driven by a rise in the number of sales units handled as well as the number of used cars sold compared with the previous year.

The transaction amount for Other was 5,766 million yen, down 3.6% year on year.

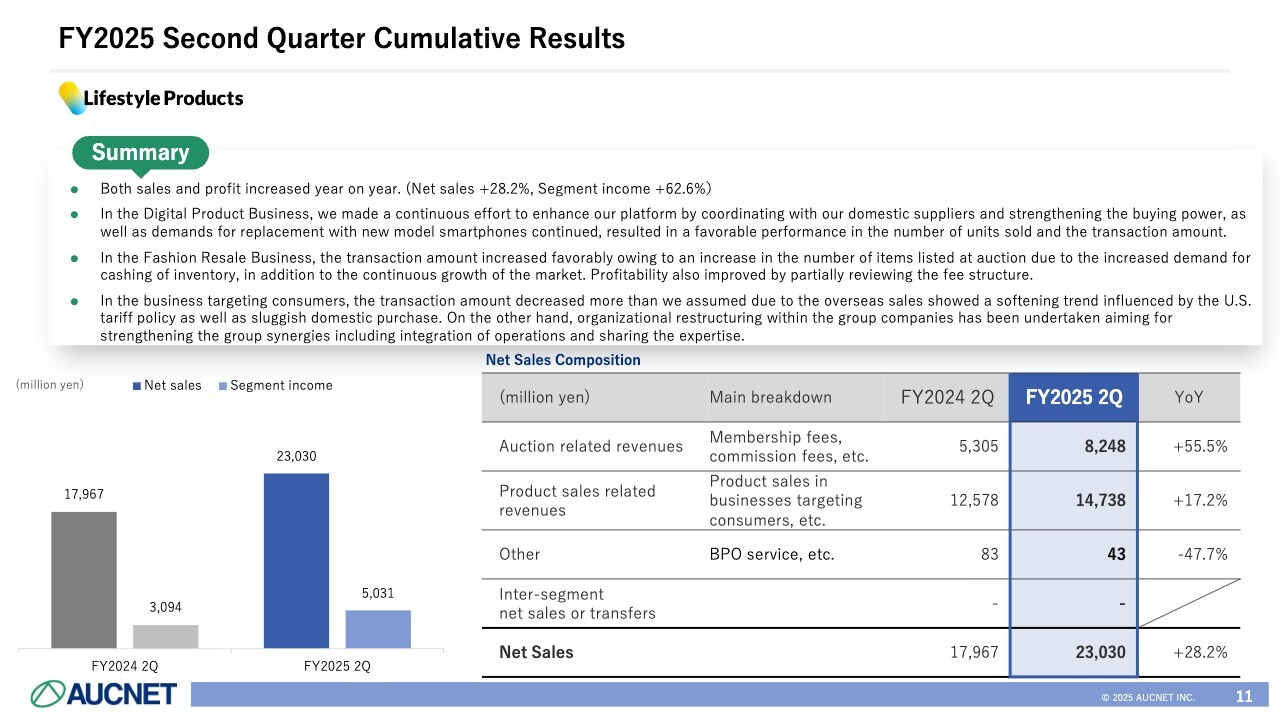

FY2025 Second Quarter Cumulative Results

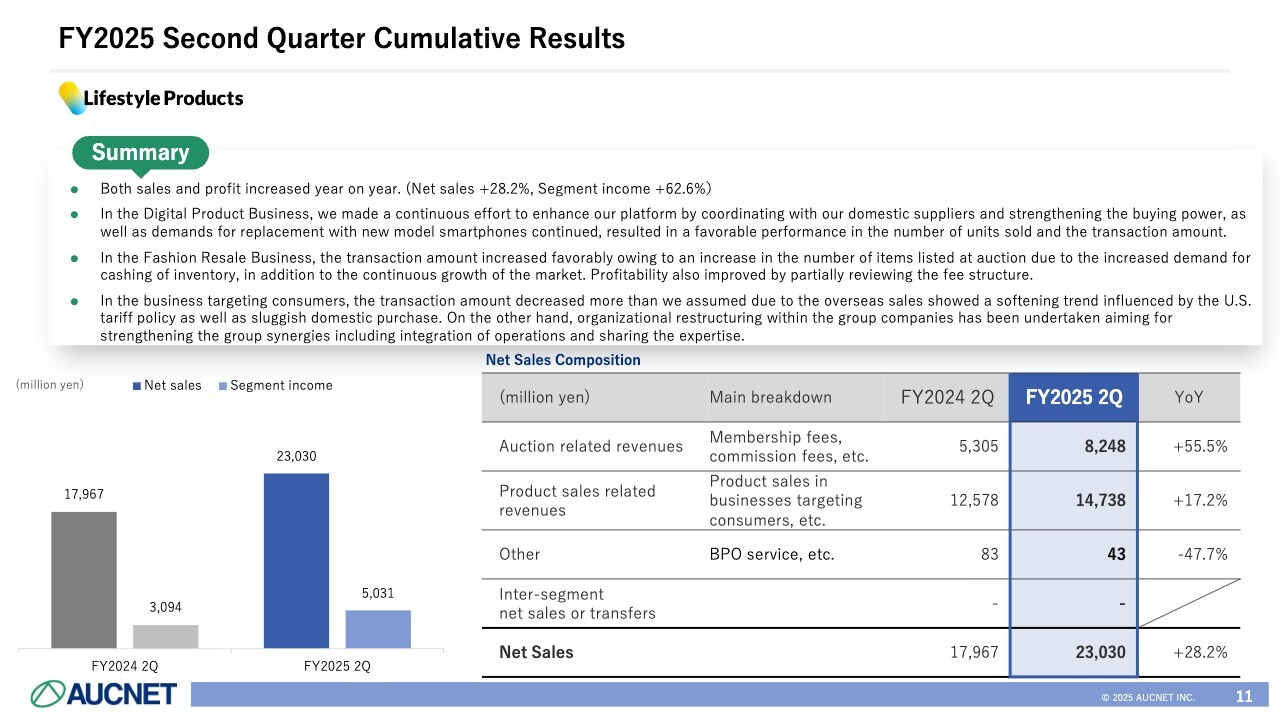

Let me now explain the details by segment. Lifestyle Products achieved year-on-year growth in both sales and profit, with net sales up 28.2% and segment income up 62.6%.

In the Digital Products Business, the main driver was smartphone distribution, with replacement demand continuing, especially for new iPhone models.

We expanded partnerships with domestic suppliers and captured demand associated with the GIGA School initiative. Meanwhile, our platform continued to grow overall, with overseas buyers in particular increasing their buying power. As a result, both the number of sales units and the transaction amount remained strong.

In the Fashion Resale Business, the B2B market continued to grow, and strong demand to liquidate inventory led to a sharp increase in listings. The transaction amount also remained strong. Additionally, a partial revision to the commission fee structure had a positive impact on earnings.

In the business targeting consumers, purchases of branded goods and domestic purchases in the retail sector remained weak. In addition, U.S. tariff policies had some impact, and retail sales in Europe and the U.S. were sluggish, leading to a slight decline in transaction amount compared with expectations.

Meanwhile, we have begun organizational restructuring within the Group to generate synergies from integrating retail operations and sharing know-how.

The bottom right of the slide shows the sales composition. At the top, the BtoB business is the main contributor, with total membership fees and commission fees from auctions and other services reaching 8,248 million yen, up 55.5% year on year.

Meanwhile, sales in the business targeting consumers came to 14,738 million yen, representing a 17.2% increase year on year, partly due to the timing of revenue recognition as a result of our M&A activities.

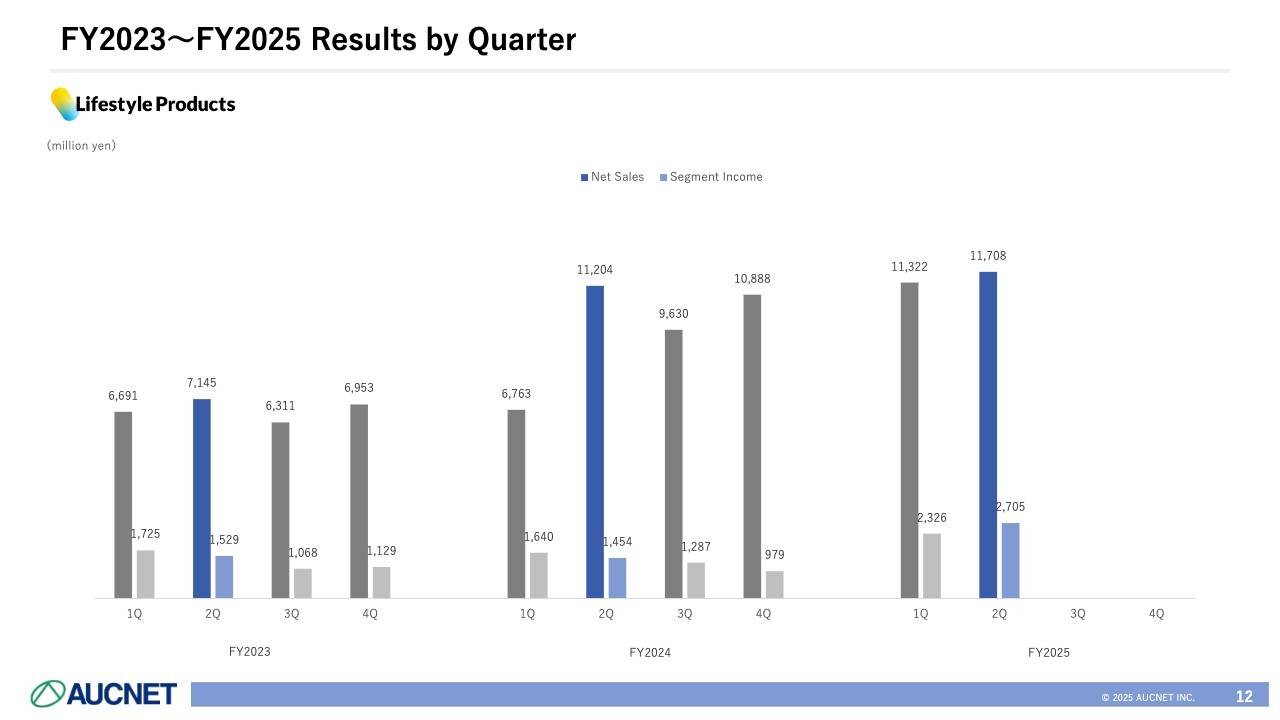

FY2023–FY2025 Results by Quarter

This slide shows quarterly performance of the segment.

FY2025 Second Quarter Business KPI

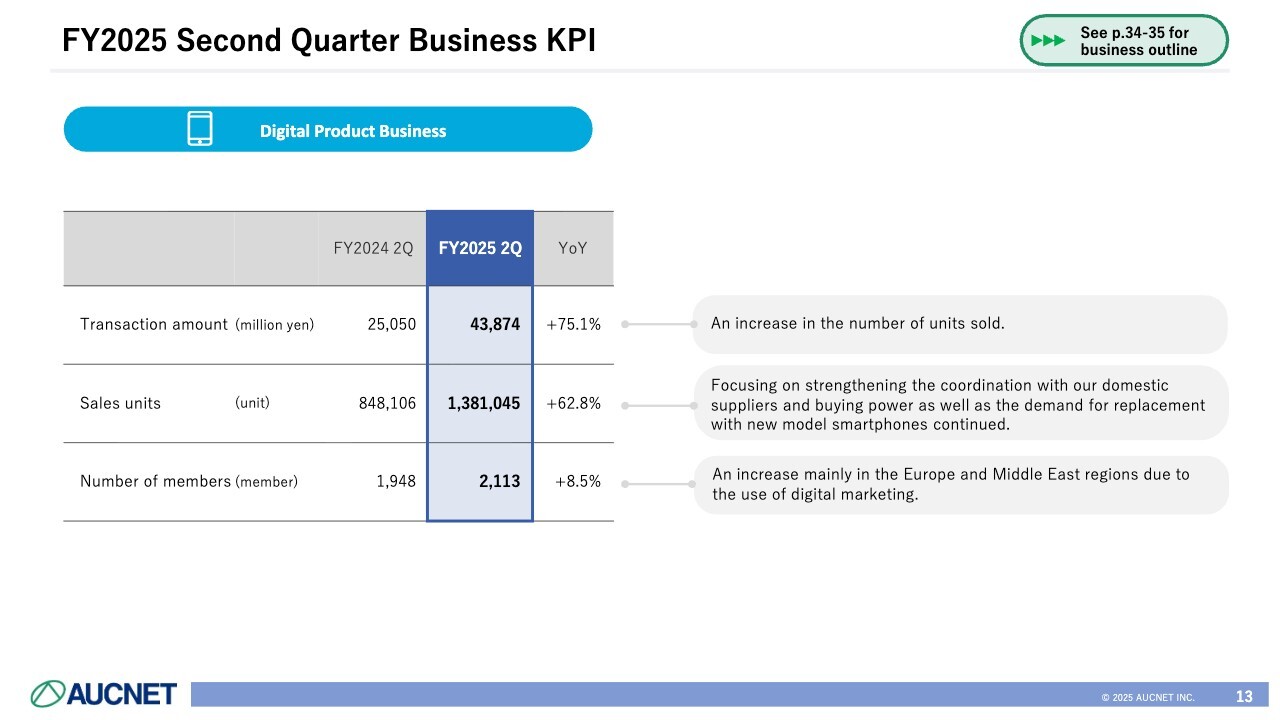

Let me now explain the KPIs. The transaction amount for the Digital Products Business was 43,874 million yen, driven by an increase in the number of sales units.

The number of sales units, the most important KPI, totaled 1,381 thousand, up 62.8% year on year. This increase in units was the largest positive factor, showing that our platform continues to grow steadily.

As membership grows, transaction prices also rise, which encourages more sellers to list their products on Aucnet. For this reason, the number of members is regarded as a critical KPI.

The number of members exceeded our target of 2,000, reaching 2,113. In particular, in regions such as Europe and the Middle East, we focused on areas closer to retail, targeting retailers directly rather than wholesalers, and actively grew membership through digital marketing.

FY2025 Second Quarter Business KPI

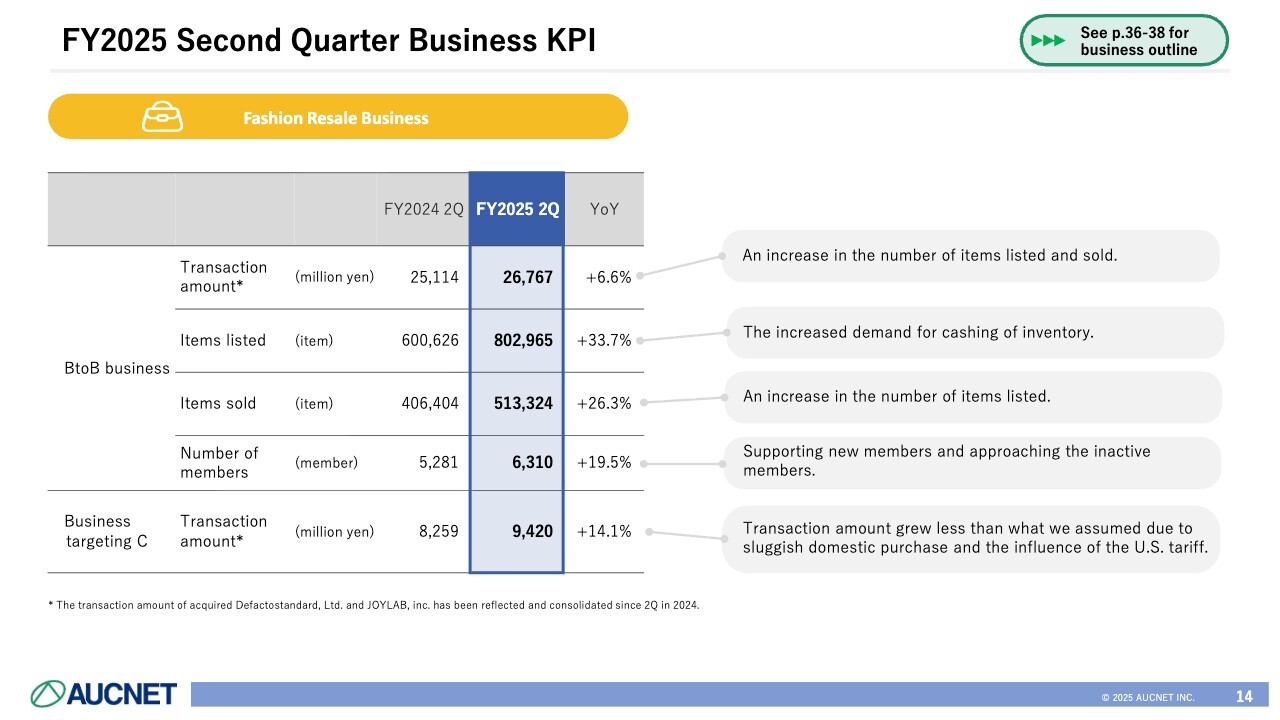

In the Fashion Resale Business, the transaction amount was 26,767 million, up 6.6% year on year.

Notably, listings grew significantly, reaching 802,965 items, a 33.7% increase year on year. Although the market has begun to stabilize, this has led to more listings on our platform, driving strong growth.

The number of items sold was also solid at 513,324. expanded to 6,310 companies, up about 20% year on year.

The transaction amount for the business targeting consumers reached 9,420 million yen, up 14.1% year on year. Even so, we are facing some challenges in purchasing, and sales have also been partially affected by tariffs and international developments. We intend to take active measures to address these issues.

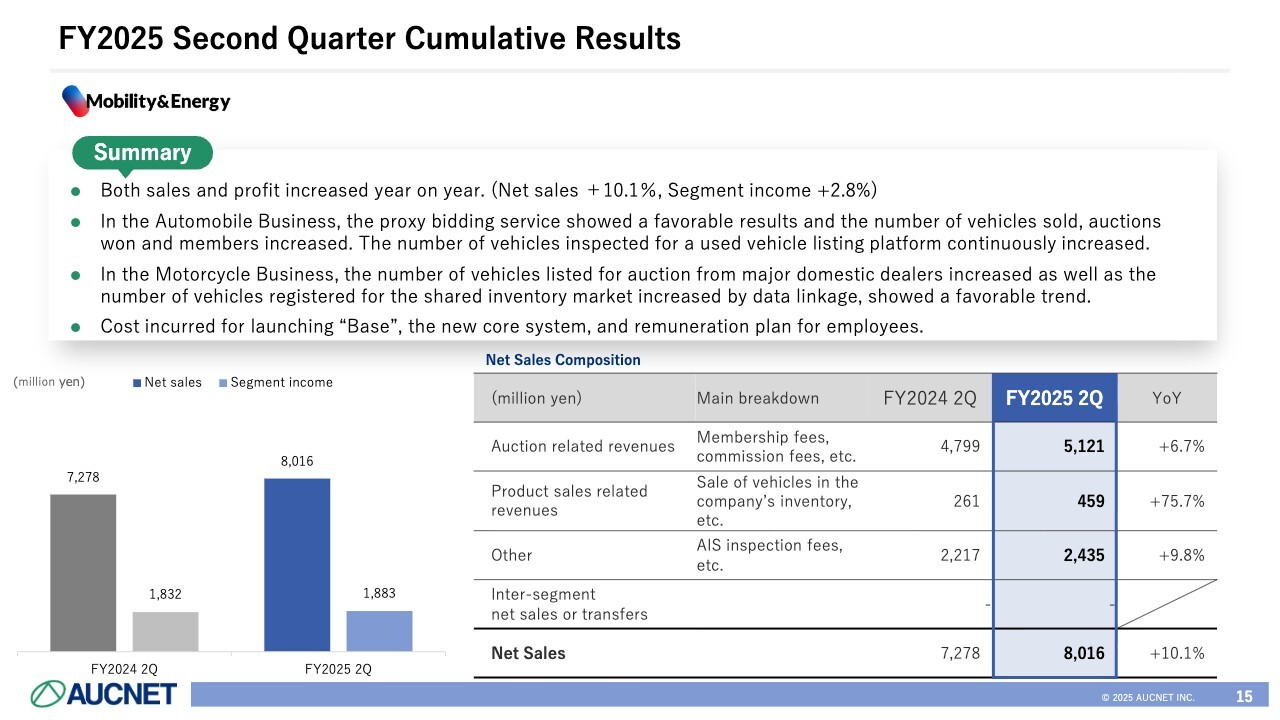

FY2025 Second Quarter Cumulative Results

Mobility & Energy posted a year-on-year increase in both sales and profit, with net sales up 10.1% and segment income up 2.8%.

Notably, in the Automobile Business, the proxy bidding service performed strongly, with increases in the number of vehicles sold, auctions won, and members.

Regarding the used vehicle listing platform, the inspection service is primarily online rather than paper-based. The number of vehicles inspected significantly increased and has continued to grow steadily, driving solid performance in the inspection business.

In the Motorcycle Business, which handles used motorcycles, we strengthened partnerships with major domestic dealerships. This led to more auction listings and higher registrations in the shared inventory market through data integration. Although smaller in scale compared with the Automobile Business, this segment also continued to perform well.

Both the Automobile and Motorcycle Businesses operate on the same core system, which was renewed for the first time in more than ten years. This resulted in some additional costs.

In addition, the stock remuneration plan for employees weighed on results, but even after these expenses, segment income remained positive.

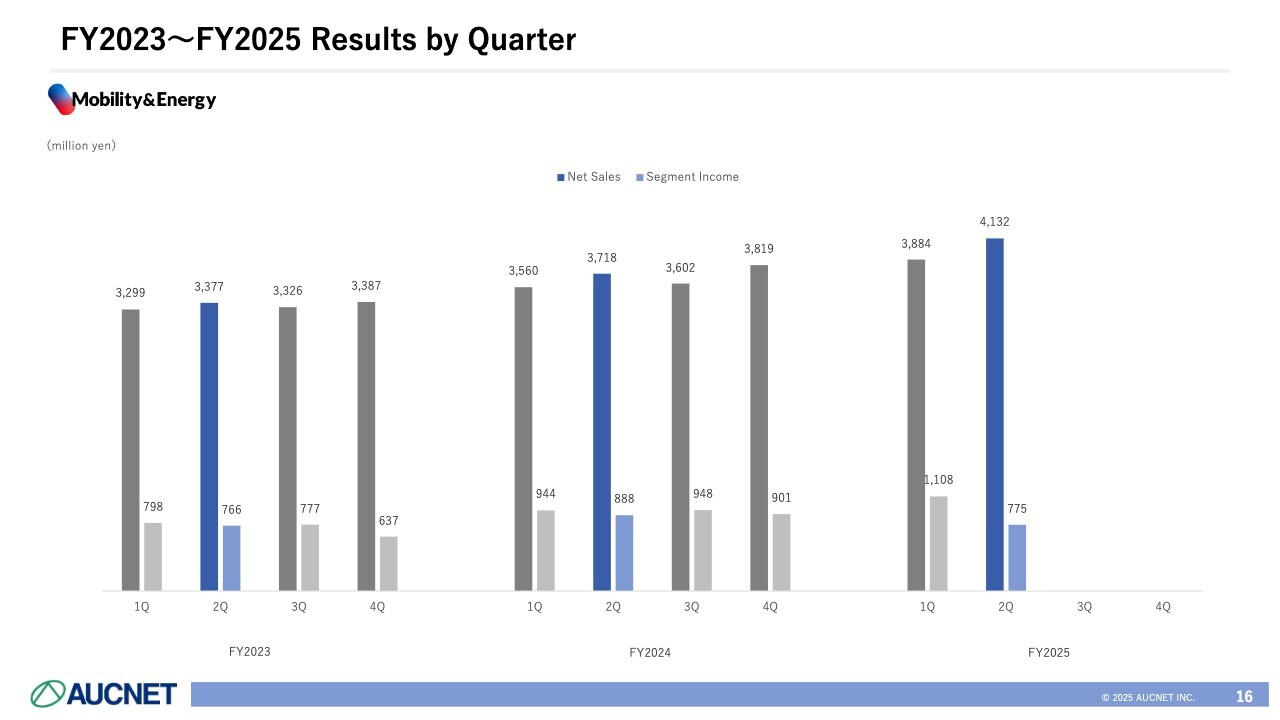

FY2023–FY2025 Results by Quarter

This slide shows quarterly performance of the segment. In Mobility & Energy, most sales come from commission fees, so net sales have been steadily increasing.

In the second quarter, segment income looks slightly lower, due to the impact of the stock remuneration plan and amortization of certain systems.

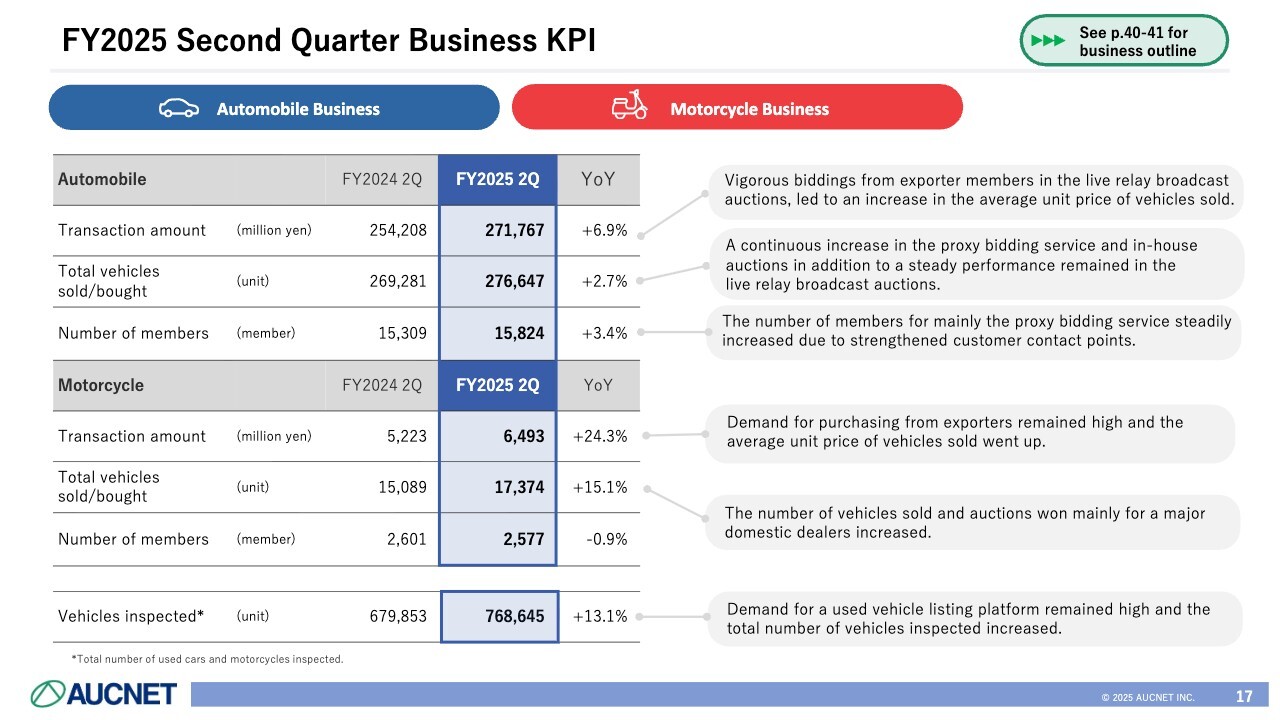

FY2025 Second Quarter Business KPI

Regarding business KPIs, the Automobile Business recorded a transaction amount of 271.7 billion yen, driven by active bidding from exporters in live relay broadcast auctions and an increase in the average unit price of vehicles sold.

The number of auctions won, or vehicles bought and sold through our platform, was 276,647, an increase of approximately 3% year on year.

In terms of the number of units, we continued to see an increase in auctions conducted through i-Auc, a proxy bidding service provided by a subsidiary, as well as those conducted by AUCNET. Live relay broadcast auctions generally performed well, with exporters actively utilizing our services.

The number of member companies reached 15,824, while membership in the i-Auc proxy bidding service continued to grow steadily.

Regarding the Motorcycle Business, the transaction amount reached 6,493 million yen, supported by strong growth in exports. The average unit price rose significantly, with the result that the transaction amount increased 24.3% year on year. The number of vehicles sold and bought also climbed to 17,374, owing partly to increased listings from major domestic sellers.

The combined number of vehicles inspected, both automobiles and motorcycles, reached approximately 769,000 units. Demand for the used vehicle listing platform remained robust, and the number of inspections has continued to grow steadily over the past few years, with the upward trend continuing this fiscal year.

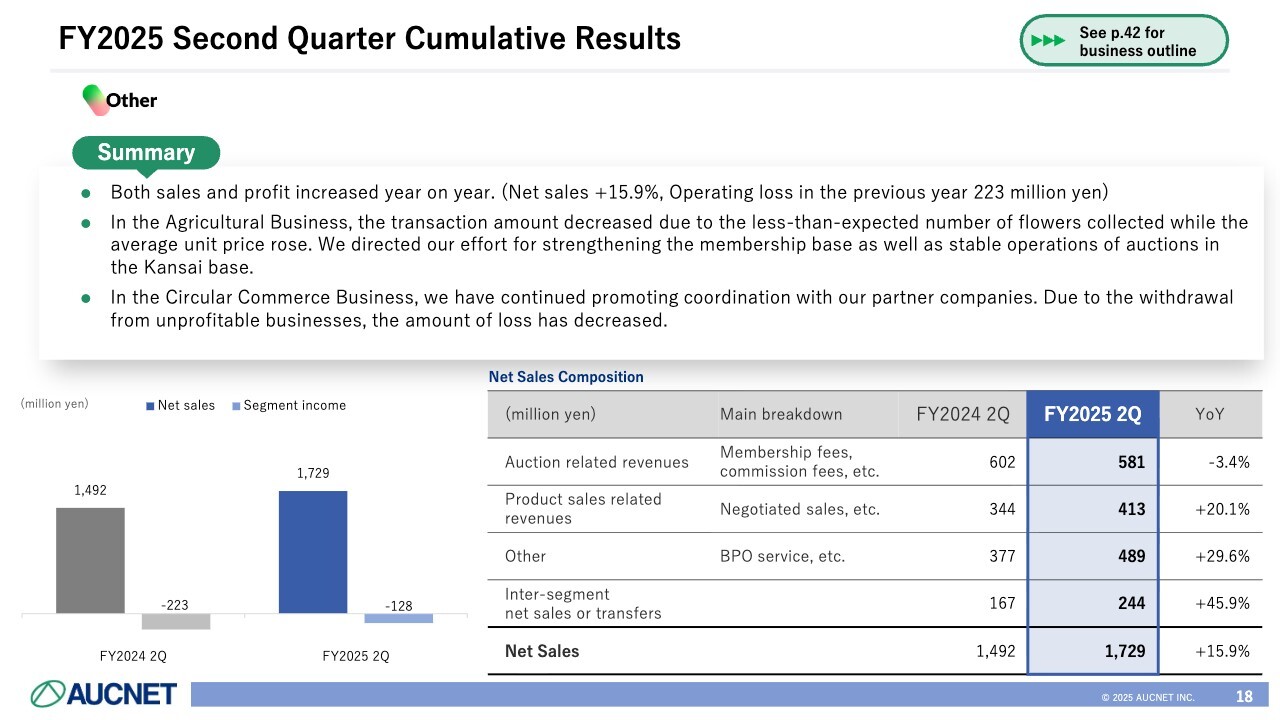

FY2025 Second Quarter Cumulative Results

As for Other, both sales and profit increased year on year, with net sales up 15.9%. The segment recorded an operating loss of 128 million yen.

The Agricultural Business saw a decline in net sales. In flower distribution in particular, the average unit price rose, but the number of flowers collected fell short of expectations. At the Kansai base, launched two years ago, we are focusing on stabilizing auction operations and building a solid membership base.

In the Circular Commerce Business, we have continued promoting coordination with our partner companies. Due to the withdrawal from unprofitable businesses, the amount of loss has decreased. Furthermore, we completed the exit of one subsidiary engaged in healthcare operations.

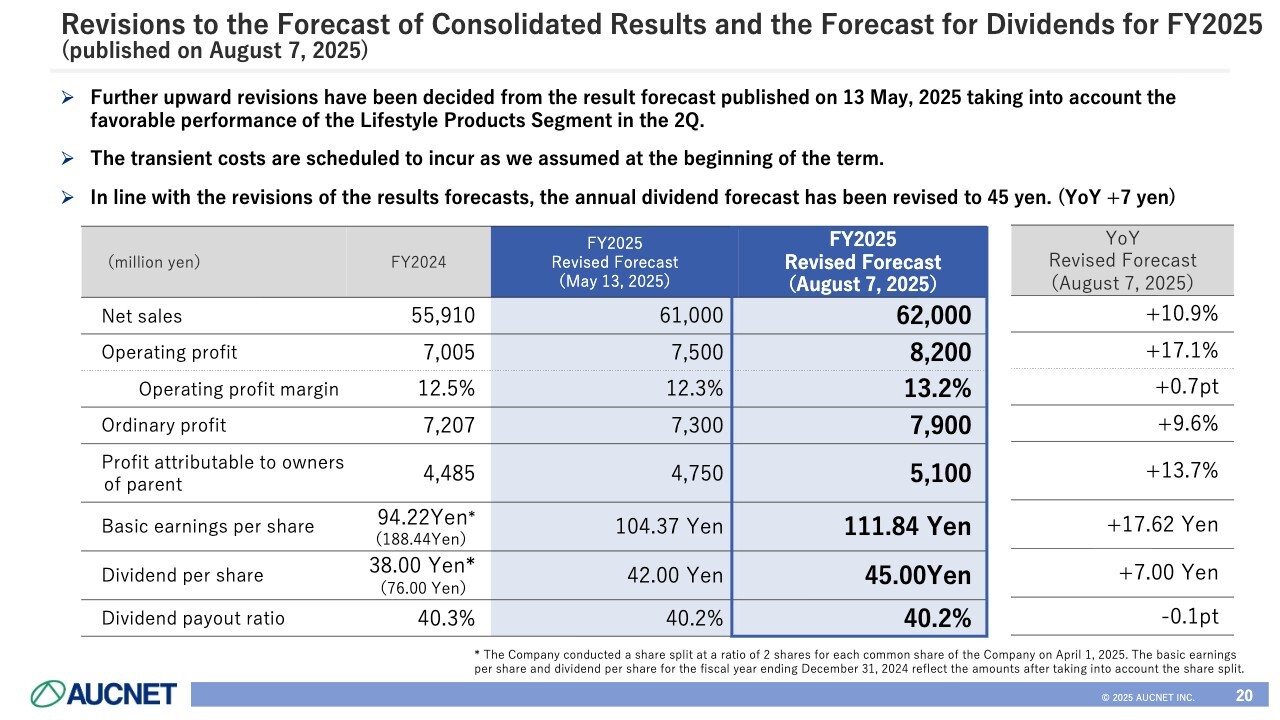

Revisions to the Forecast of Consolidated Results and the Forecast for Dividends for FY2025 (published on August 7, 2025)

I will now move on to the topics. The first is the revisions to the full-year consolidated results and dividend forecasts.

In the first half, Lifestyle Products delivered very strong results. Based on this performance, we decided to make a further upward revision to the earnings forecast announced at the end of the first quarter.

At the beginning of the fiscal year, we positioned this fiscal year as one of “higher revenue but lower profit,” reflecting our intention to invest for future growth. We had planned to incur certain one-time costs, and policy remains unchanged. We will continue to allocate funds steadily to investments for sustainable growth.

Along with the revisions to the earnings forecast, we also revised our dividend forecast, raising the annual dividend to 45 yen per share, with the aim of maintaining a dividend payout ratio of over 40%. This represents an increase of 7 yen year on year.

Net sales are now projected at 62,000 million yen, up 10.9% year on year. Operating profit is targeted at 8,200 million yen, a 17.1% increase.

We expect an operating profit margin of 13.2%. Ordinary profit is forecast at 7,900 million yen, while profit attributable to owners of parent is projected at 5,100 million yen, a 13.7% increase year on year.

Basic earnings per share is forecast at 111.84 yen. The annual dividend per share is expected to be 45 yen, representing a payout ratio of 40.2%.

In April 2025, the Company conducted a share split. As a result, the dividend amount itself is halved, but on a pre-split basis, it would be equivalent to 90 yen.

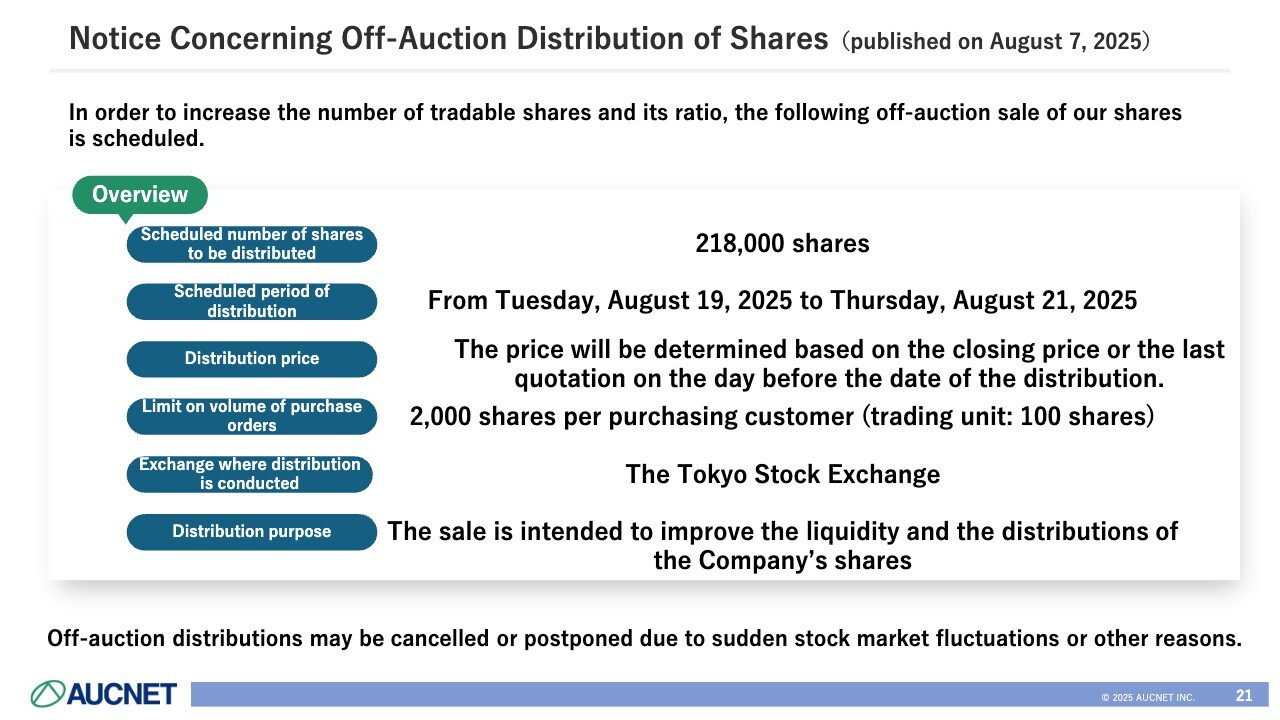

Notice Concerning Off-Auction Distribution of Shares (published on August 7, 2025)

The second topic is the notice concerning the off-auction distribution of shares. The Company plans to conduct the distribution of shares with the aim of improving the trading liquidity. The number of shares to be distributed is 218,000 shares, and the distribution is scheduled to take place between August 19 and August 21. The distribution price will, in principle, be determined based on the closing price or the final quoted price on the business day prior to the distribution date.

As noted in the annotation at the bottom of the slide, the distribution may be canceled or postponed if there is a sudden stock market fluctuation or if execution becomes difficult.

We recognize that the trading liquidity remains a challenge at present, and we are implementing this measure to improve the trading liquidity, even if only modestly.

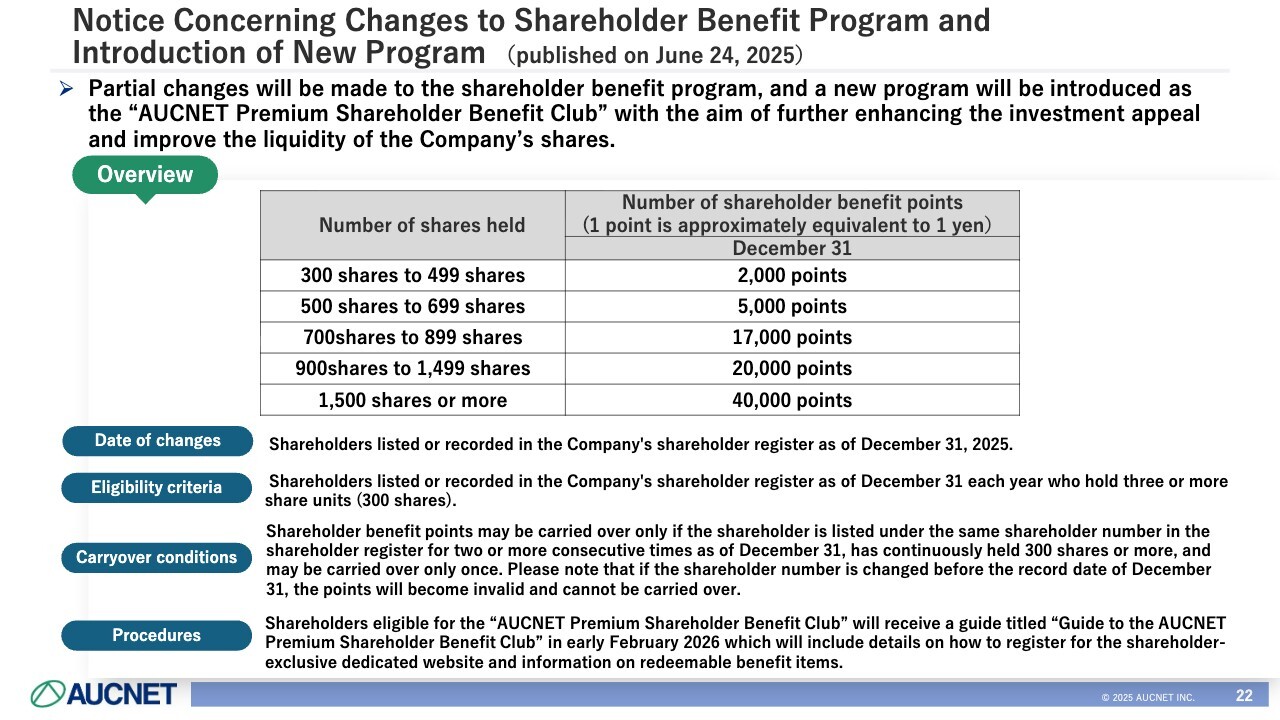

Notice Concerning Changes to Shareholder Benefit Program and Introduction of New Program (published on June 24, 2025)

The third topic is the notice concerning changes to the shareholder benefit program and the introduction of a new program, disclosed on June 24. To enhance the attractiveness of investment in the Company’s shares and improve trading liquidity, the contents of the shareholder benefit program have been revised, and a new program called the “AUCNET Premium Shareholder Benefit Club” has been introduced.

As outlined on the slide, the program is structured so that the number of points awarded will vary across five levels depending on the number of shares held. The Company has introduced this new program with the aim of encouraging individual shareholders to hold shares in larger units so that they may enjoy greater benefits.

The changes are scheduled to take effect for shareholders as of the end of December 2025.

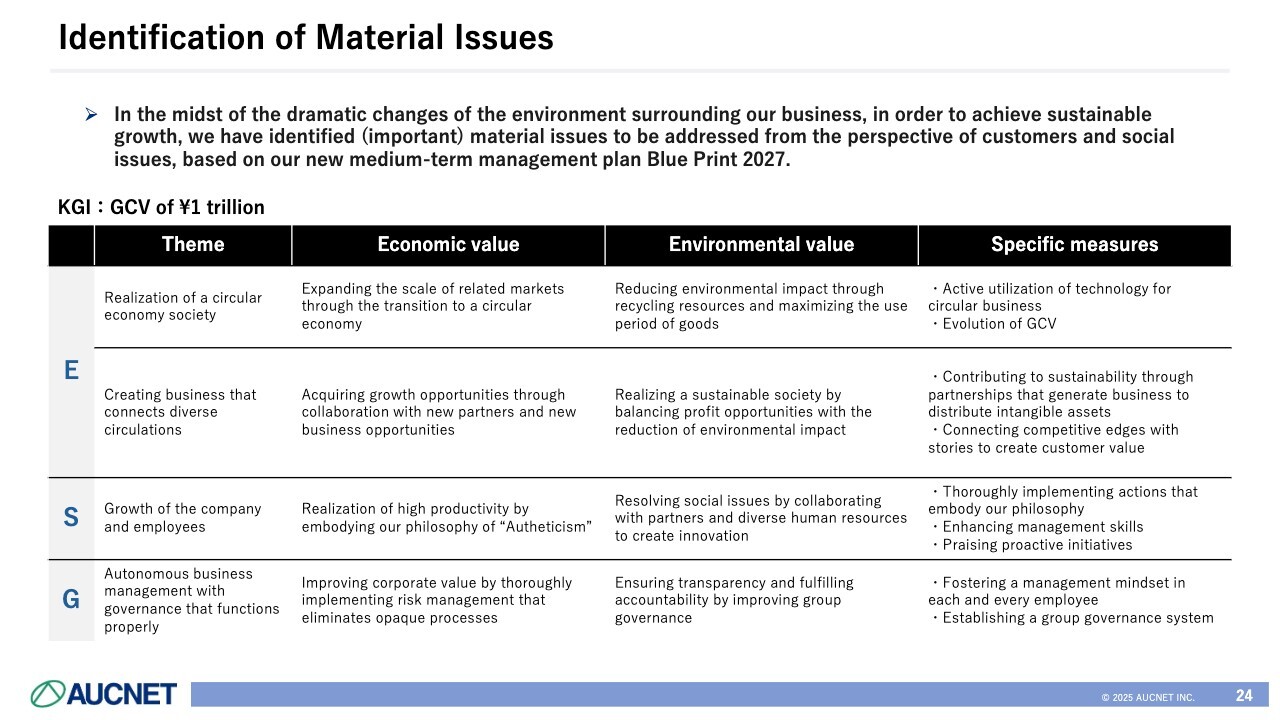

Identification of Material Issues

Lastly, I would like to address sustainability. In recent years, greater disclosure of materiality has been required, and we would like to summarize and share the initiatives we can undertake in this area.

In particular, we have formulated a new medium-term management plan, “Blue Print 2027.” In alignment with this plan, we have identified our material issues from both the customer perspective and the perspective of broader social challenges.

The first materiality theme relates to the Environment (E). As noted on the slide, our theme is “Realization of a circular economy society.” The circular economy is becoming a major global trend, and we see this as a business opportunity.

As a company that distributes reuse-related products through auctions, we aim to reduce environmental impact by promoting resource circulation and extending product lifecycles. We refer to this as “Market Design” and intend to actively apply various mechanisms and technologies to expand circular businesses.

The second environmental theme is also linked to the circular economy. Increasingly, companies engaged in primary distribution businesses—which historically had little connection with reuse—are seeking to participate in the circular economy.

Through partnerships with these companies, we aim to provide services that enable the circular economy to be viewed not as a cost, but as a means of achieving both economic efficiency and environmental sustainability. Leveraging our resources, we are working to realize such services.

The third materiality theme is Social (S). Our corporate philosophy of “Authenticism,” a principle left by our founder, has become well embedded in the Company.

We will continue to promote actions that embody this philosophy, reinforce management, and drive innovation through collaboration with partners and diverse human resources.

The fourth materiality theme is Governance (G). By strengthening governance, we will ensure transparency and fulfill our accountability. This is also tied to our corporate philosophy, and we will continue to foster management awareness among all employees and enhance our Group-wide governance framework.

That concludes our explanation of the first-half financial results. This fiscal year marks the 40th anniversary of our founding, and we are pleased to have delivered solid results for the first half of FY2025. Building on this momentum, we intend to continue driving business growth in the second half. We appreciate your continued support.

Q&A: Handling of Tablet Devices in the Digital Products Business

Moderator: We have a question: “Could you update us on the handling of GIGA School tablet devices in the Digital Products Business.”

Fujisaki: As has been reported in various media, during the COVID-19 pandemic a few years ago, tablet devices were distributed to students under government support, with each municipality taking the lead. After a certain period, this distribution cycle was completed, and replacement demand has now emerged. As a result, subsidies have been allocated again under the scheme.

In addition, the issue of what to do with the initial round of devices became a topic of discussion around two years ago, and in response, we have been preparing a distribution support framework. As a result, although we cannot disclose the exact number of units, some of these devices have already started to enter the Company’s distribution channels.

We have invested in warehouse facilities capable of handling large volumes of devices, ensuring that we are fully prepared to receive them. Another strength is our global network of buyers who can purchase a wide range of devices. These strengths have been recognized, and as a result, we have received inquiries from various local governments.

Q&A: M&A and Integration Effects in the Fashion Resale Business

Moderator: We have a question: “With respect to the Fashion Resale Business, you mentioned that you have begun restructuring the business targeting consumers. When do you expect the specific synergy effects to begin to materialize?”

Fujisaki: In the Fashion Resale Business, the Company had primarily been engaged in the BtoB auction business. However, several years ago, we executed M&A of two companies engaged in purchasing and sales.

One is Gallery Rare Ltd., which specializes in high-end items such as branded bags and luxury watches. The other is Defactostandard, Ltd., which mainly operates online and handles relatively affordable branded goods, specifically in the range of several tens of thousands to several hundred thousand yen.

Since the customer bases and segments of these two companies are somewhat different, they have been operated separately even after the M&A. However, on July 1 of this year, we integrated the two companies and established a new company, CircLuxe Inc. Within this new company, we are promoting the integration of areas where consolidation is possible.

Specifically, we have consolidated the warehouses of the BtoB business and Defactostandard, Ltd., which had previously been operated separately in part. This allowed us to secure additional floor space and reduce rental costs. In addition, by integrating operations, we are able to achieve further cost savings.

Furthermore, in the past, there was insufficient coordination when placing purchased products into BtoB distribution. Going forward, with smoother flows of goods among BtoB, CtoB, and BtoC, we expect to generate synergy effects.

Q&A: Factors Behind the Decline in Profit Margin of Mobility & Energy

Moderator: We have a question: “The profit margin of Mobility & Energy appears to have declined compared with the first quarter. Could you explain the factors behind this?”

Fujisaki: We view Mobility & Energy as being very stable while gradually increasing profitability.

In the first quarter, we were able to secure solid profit. However, in the second quarter, costs such as stock-based compensation for employees had an impact. Since this business involves over 100 employees, and several hundred including subsidiaries, such costs were incurred.

In addition, we updated our core system. As depreciation began to be recorded from the second quarter, the results reflect a combination of temporary and ongoing factors that compressed profit. Therefore, if you look only at the second quarter, it appears to have declined somewhat, but overall, the business remains on a steady trajectory.

Q&A: Impact of U.S. Tariff Policy on the Business

Moderator: We have a question: “Could you tell us about the impact of U.S. tariff policy on your business?”

Fujisaki: Rather than just our Company, in the reuse market overall, about half of automobiles, nearly 30% of branded goods in our case, and almost the entirety of digital products in our case are in demand overseas and are being distributed from Japan.

In this context, given that the U.S. is a very large market, I understand the concern that the implementation of tariff policy may have a certain level of impact.

The greatest impact has been on the Fashion Resale Business. Since there are customers in the U.S. who purchase directly, there has been some minor negative impact on the retail division.

On the other hand, with respect to BtoB auctions, while we initially had considerable concerns, the actual impact was not as significant as expected. This is also one of the strengths of the auction mechanism: when there is both the highest bidder and the second-highest bidder, even if the highest bidder is a U.S. customer, if the second-highest bidder is from another country, that bidder will purchase the item.

As a result, rather than items going unsold, the impact is limited to a slight decrease in selling prices by about one bid unit. Thus, the diversification of buyers through portfolio allocation serves as a strength, and there has been no significant effect on transaction amounts.

Looking ahead, we will continue to monitor developments closely and build a structure that enables flexible responses.

Q&A: Policy and Consideration Process for M&A

Moderator: We have a question: “Could you tell us about the consideration process for M&A? Will the Fashion Resale Business be the first target?”

Fujisaki: In our medium-term management plan, the Company has set a framework of 5,000 million yen to 7,000 million yen. However, this does not mean that we intend to pursue M&A simply for the sake of expansion because the framework has been set.

We believe that the core of our business should fundamentally be BtoB. Therefore, we are narrowing our focus to deals where synergy effects can be expected. We have not established any particular priority order among businesses. That said, M&A inherently involves timing, chance, and encounters, so we do not intend to pursue it in a forced manner.

We also recognize that our internal structure is gradually being enhanced. Accordingly, we intend to promote initiatives that enable us to conduct consideration appropriately and advance M&A efficiently.

Q&A: Purpose of Expanding the Business Targeting Consumers

Moderator: We have a question: “In the Fashion Resale Business, what is the purpose of expanding the business targeting consumers?”

Fujisaki: Regarding the intention to expand the business targeting consumers in the Fashion Resale Business, our basic policy that the core of our business should fundamentally be BtoB remains unchanged.

At the same time, in the business of handling branded goods, there are industry-specific customs and characteristics. Similar to the automobile market in the past, there is a tendency for businesses to concentrate where large volumes are distributed, and without a certain transaction amount, it is difficult to establish a presence in the market.

In this context, through the M&A of Gallery Rare Ltd. and Defactostandard, Ltd., the Company has achieved one of the industry’s top levels of transaction amount, placing it among the top three players.

While maintaining this position and firmly advancing BtoB, we are working to expand this business.

However, we do not intend to expand the business targeting consumers without limit. Rather, having established CircLuxe Inc. through M&A, we aim to strengthen BtoB in coordination with this new company and grow the business further.

Q&A: Purpose of Changes to the Shareholder Benefit Program

Moderator: We have a question: “What was the purpose of changing the shareholder benefit program?”

Fujisaki: While we maintain close communication with institutional investors, the Company has faced the issue of having a relatively small number of individual shareholders. To make our shares more attractive to individual shareholders, we partially revised the shareholder benefit program.

If the daily share price or trading volume is unstable, there is a risk that the share price may gradually decline. To address this, we revised the benefit program to encourage shareholders to hold multiple trading units rather than just one, while also aiming to increase the number of shareholders.

Q&A: Basis for Operating Profit Forecast

Moderator: We have a question: “Following the second quarter results, could you explain the basis for the operating profit forecast for the second half and the full year?”

Fujisaki: Considering that the progress rate in the first half was very high, exceeding 70%, I understand this question to be whether our view is somewhat conservative.

The Company tends to be slightly front-loaded on a full-year basis. Taking this into account, we expect Lifestyle Products and Mobility & Energy to return to around the same level as the previous year in the second half.

In addition, there have been transitory costs. In particular, this fiscal year, we are putting significant effort into structural reforms of operations, and costs have been incurred not only in the Fashion Resale Business but also in the Agricultural and Automobile Businesses, such as those arising from the relocation of operation centers.

Please understand that the earnings forecast reflects these factors.

Q&A: Factors Driving the Share Prices

Moderator: We have a question: “The share price has been on an upward trend recently. Could you tell us if there are any factors, other than business performance, that are driving the share price?”

Fujisaki: The recent share price has been very strong, and I am pleased about that. Having achieved higher sales and higher profits for four consecutive fiscal years, and having delivered solid results in the first half of FY2025, I believe these factors are being recognized.

While I think business performance is the main factor, we have also implemented various IR measures such as the share split, changes to the shareholder benefit program, and share repurchases. I believe these have also been positively evaluated, and going forward, we intend to continue taking solid measures regarding IR.